Offered by the Department of Mathematics

BSc in Financial Engineering (external) degree programme focuses on creating new financial strategies and tools used to forecast financial trends, develop financial instruments / models and establish new methods that are beneficial to businesses and organizations to make strategic financial decisions. Students pursuing this degree will learn essential Mathematics, Statistics, Language and Computer Skills, Basic Economics & Accounting, Quantitative techniques, Quantitative finance, Financial modeling, Risk management, Corporate finance, Professional development & Practices in finance.

Eligibility

GCE Advanced Level Examination (local) – Three passes in one sitting in Mathematics/ Biology/ Commerce Streams

OR

Equivalent Curriculum to local GCE Advanced Level Examination (eg: Edexcel, London A/L, Cambridge A/L, etc. ) including Mathematics as a subject

OR

Any other equivalent academic/professional qualification acceptable to the faculty and the senate

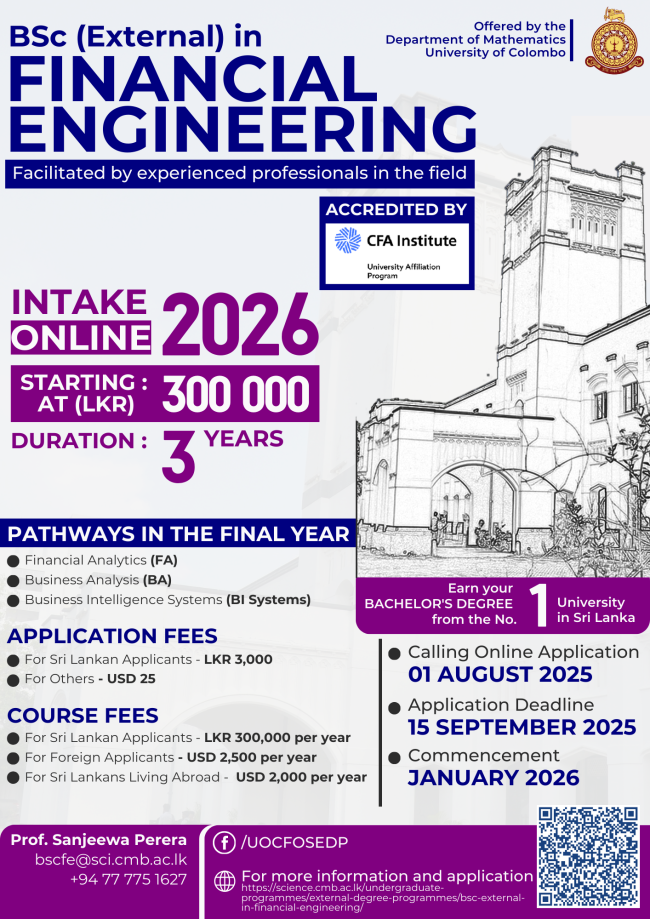

Course Fees

- For Sri Lankan Students – LKR 300,000/- per year

- For Sri Lankan Students Coming from a Foreign Territory – USD 2,000 per year

- For International Students – USD 2,500 per year

Application Fee

- For Sri Lankan Students: LKR 3,000/-

- For Sri Lankan Students Coming from a Foreign Territory : USD 25

- For International Students: USD 25

*The course fee payment is not acceptable in installments.

The BSc in Financial Engineering program at Department of Mathematics, University of Colombo recognizes essential topics from the Certificate in ESG Investing from CFA Institute. This professional certificate offers both practical application and technical knowledge in the field of ESG investing.

CISI Accreditation for BSc in Financial Engineering Graduates

We are pleased to announce that graduates of the BSc in Financial Engineering program are now eligible for registration with the Chartered Institute for Securities & Investment (CISI).

Eligible graduates may complete their registration through the following link:

Dates to be remembered (Intake 2026)

- Calling online application for the 2027 intake: August 2026

- Interviews for the 2027 intake: September 2026

- The final list of the 2027 intake: October 2026

- Registration of 2027 intake at CCUC: November 2026

- Inauguration of the program for 2027 intake: January 2027

- Commencement of the program for 2026 intake: January 2027

- Calling online application for the 2027 intake: August 2026

For Any Inquiries:

Coordinator

Prof. Sanjeewa Perera

bscfe@sci.cmb.ac.lk

+94 777 751 627

Pre-registration – 2026 Intake

Rationale

The drive toward financial market expansion and development suggests the need for people who are able to identify, evaluate, forecast, disseminate and provide integrated solutions to meet the needs of financial sector. “Financial Engineering” continues to be one of the fastest growing areas within modern financing/banking. Together with the sophistication and complexity of modern financial products, this exciting discipline continues to act as the motivating factor for new mathematical models and the subsequent development of associated computational schemes. Although relatively young, financial mathematics has developed rapidly into a substantial body of knowledge and established part of mathematical science. The proposed revision is designed to fulfill the demand for expertise in the drive toward financial expansion and development.

The course is structured to support all part-time external students to engage with the Lecturers in the course modules continuously. Learning Management system (LMS) is used as a self-learning assessment and evaluation mechanism.

The intellectually exciting and practical Finance course will prepare students for a range of careers in the financial analysis field within Sri Lanka and internationally. With a degree in Financial Engineering students can harness skills necessary for economic analysis, financial forecasting, and financial practice as well as for financial consultancy, advisory and financial product development/analysis.

Programme Duration

The duration of the program is 3 years. During each year, the programme is conducted over 2 semesters of 20 weeks. The courses are offered in Blended Mode. 100% of lessons and discussions are conducted online during weekends (Saturday – 2 hours, Sunday – full day).

Indented Learning Outcomes of BSc in Financial Engineering

The end of the 3 years (SLQF Level 5) BSc in Financial Engineering Degree holders should be able to:

- demonstrate knowledge and proficiency in the terminologies, theories, concepts, practices and skills specific to the field of finance and insurance financial product development.

- observe and interpret financial markets to uncover potential opportunities and construct financial portfolios.

- apply best practices in financial management to make plans, organize projects, monitor outcomes and provide financial leadership.

- apply the Standards of Practice and Codes of Conduct of Financial Practitioners to address ethical challenges within the business environment and demonstrate intellectual maturity in a global setting.

- practice professionalism and uphold ethical standards and improve/update skills required for employment and life-long learning.

- effectively communicate & disseminate knowledge, information and ideas to specialist and a wider society

- perform independently as well as interdependently

Programme Structure

BSc in Financial Engineering will be completed in three years (90 Credits / SLQF Level 5) and it consists of three levels.

LEVEL I: Diploma in Financial Engineering (30 Credits)

LEVEL II: Advanced Diploma in Financial Engineering (60 Credits)

LEVEL III: BSc in Financial Engineering (90 Credits)

*Please find the more details of the programme:

Student Handbooks:

- BSc (External) in Financial Engineering Handbook 2026

- BSc (External) in Financial Engineering Course Catalog 2026

- BSc (External) in Financial Engineering Course Catalog 2025

- BSc (External) in Financial Engineering Course Catalog 2024

- BSc (External) in Financial Engineering Course Catalog 2023

- BSc (External) in Financial Engineering Course Catalog 2022

- BSc (External) in Financial Engineering Course Catalog 2021

General Guidelines:

Examination Guidelines:

Evaluation Criteria

The theory course modules will be evaluated through written examinations and/or assignments where appropriate. Laboratory course modules will be evaluated by assignments and/or semester end examinations. In some instances, course units may require a mixed mode evaluation including continuous assessments.

Further Information

Further information regarding the Program can be obtained by contacting the program coordinators

The contact details of the program coordinators are as follows.

Programme Coordinator

Email: bscfe@sci.cmb.ac.lk

Coordinator/Examinations

Email: erandi@maths.cmb.ac.lk

Coordinator/ Learning Resources

Email: liyanage@maths.cmb.ac.lk

Coordinator/ Student Affairs

Email: yashika@maths.cmb.ac.lk

Coordinator/ Quality Assurance

Email: suranimalee@maths.cmb.ac.lk

Administrative Assistant

Email:bscfe@sci.cmb.ac.lk

Administrative Assistant

Email:bscfe@sci.cmb.ac.lk

A significant milestone was marked on 9th October 2025 at the Senate Hall of the University…

The UAP certificate presentation ceremony for the BSc in Financial Engineering degree program, conducted by the…